Cover photo: Trimble

Innovators Assemble

In the second part of our receiver feature, top receiver manufacturers discuss what’s on the horizon for GNSS receivers: recent and upcoming innovations, combating spoofing and jamming, fusing GNSS with other sensors, and the impact of increasing accuracy both for professional surveyors and consumers.

In January, we featured responses from NovAtel, Trimble, Unicore, Topcon, Hemisphere GNSS, CNC Navigation and Septentrio to questions about their recent and upcoming innovations in the design and manufacturing of GNSS receivers. We continue in this issue with responses to the same questions from Javad GNSS, Swift Navigation, Eos Positioning Systems, Tersus GNSS, TeleOrbit, Allystar Technology and NTLab.

All GNSS receiver manufacturers agree that spoofing and intentional and unintentional jamming are serious challenges. Their approaches to dealing with these challenges differ, however, as they rely on different combinations of technologies on both their receivers (such as monitoring cycle slips and using analog-to-digital converters, correlators and notch filters) and their antennas (such as using array antennas), as well as the new Galileo authentication service.

Photo: Tersus GNSS

Many receiver manufacturers now routinely use optical, inertial and other sensors — which continue to drop in price and increase in performance — to supplement GNSS signals where they are degraded or denied, especially in the automotive market.

Carrier phase positioning and correction services are increasingly improving the accuracy of survey stations and reducing their price. Meanwhile, submeter accuracy is spreading beyond surveying to other industries. Performance in challenging conditions also continues to improve, thanks largely to the increase in the number of GNSS constellations, available satellites and frequencies. (For a review of recent developments in antennas, see our companion article here.)

On the consumer side, the introduction of multi-frequency GNSS receiver chips, the increased use of correction services, and, in a few countries, the deployment of thousands of additional base stations will continue to increase the location accuracy of cell phones and other consumer devices, enabling new applications. However, in these devices size and cost limitations make antenna performance particularly challenging. (See Part 1 here.)

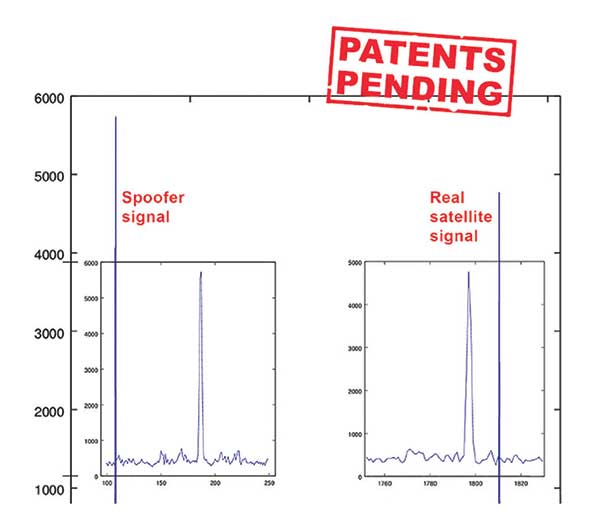

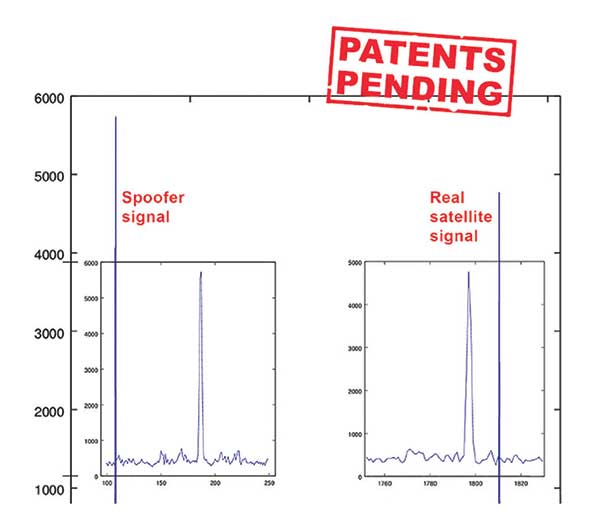

Javad GNSS

Jamming and Spoofing. “We protect you against jammers and spoofers like no one else can,” said Javad Ashjaee, founder and CEO of Javad GNSS. “We use multiple techniques to detect spoofers, the most important being the use of digital signal processing to detect more than one peak. First, with 864 channels and about 130,000 Quick Acquisition Channels in our Triumph chip, we have resources to assign more than one channel to each satellite to find all signals that are transmitted with that GNSS PRN code. If we detect more than one reasonable and consistent correlation peak for any PRN code, we know that we are being spoofed and can then identify the spoofer signals and ignore the wrong peak.”

An example of two peaks. (Chart: Javad GNSS)

Ashjaee described additional techniques:

- The J-Shield filter blocks out-of-band interference.

- Sixteen 255th-order FIR anti-jam digital filters protect against static in-band interference, and 16 adaptive 80th-order digital filters protect against dynamic interference.

- Javad products measure the level of interference as a percentage of in-band noise above normal.

- The Triumph chip has a powerful spectrum analyzer. Each spectrum shows the power and the shape of the interfering signals and jammers. This is more powerful and more efficient than using a commercial spectrum analyzer to evaluate the environment.

- The chip also keeps a record of Automatic Gain Control, which is another indicator of external signals. A change in AGC can indicate interference.

- Deviation of SNR from the expected value is another important indicator of interference.

“Usually there are over 100 signals available at any given time, and we need only four good signals to compute position. It is extremely unlikely that we can be spoofed without our knowledge.” Ashjaee concluded. “We will immediately recognize and take corrective actions.”

Jamming and spoofing protection is available on all Javad GNSS receivers and OEM boards. Read more about Javad GNSS’s jamming and spoofing protection in the December 2019 issue.

Sensor Fusion. “To support users in environments where GNSS RTK solutions are difficult or impossible to obtain,” Ashjaee said, “Javad GNSS has invented the J-Mate, which is a remotely controlled robotic EDM device and digital camera. GNSS RTK and optical can be seamlessly integrated using the J-Mate as the seventh RTK engine. Just set up a Triumph-3 on top of a J-Mate and a Triumph LS on top of a zebra rod, making the former pair the RTK base station and the latter pair the RTK rover.” Read more about Javad GNSS’s RTK and Optical United solution in the November 2019 issue.

Swift Navigation

Jamming and Spoofing. “Receivers have become more robust to intentional jamming by mimicking the jammers’ behavior to cancel it,” said Alex Pun, staff product manager for Swift. “Nevertheless, advanced jamming and spoofing mitigation often imply array antennas. A real evolution lies in considering these threats only in terms of the availability of the GNSS sensor, now part of a complete multi-sensor positioning engine such as Starling.”

Sensor Fusion. IMUs, visual sensors and GNSS will aid each other in different types of environments and scenarios, explained Pun. “Sensors are becoming more affordable, and their performance increases with each new generation. Sensor fusion will be the glue that will bind them to provide a precise positioning solution.”

Surveying. The combined use of carrier-phase positioning and correction services, such as Swift’s Skylark, will greatly improve accuracy and reduce the cost of survey stations, because they make their accuracy less dependent on the intrinsic performance of the receiver and the antenna, Pun said. “A global service eliminates the need for an individual base station.”

Consumer Devices. “The introduction of dual-frequency GNSS receivers from chip manufacturers will help improve positioning in cell phones and other consumer devices,” Pun said. “These chips, coupled with a widely available correction service such as Skylark, will greatly improve their performance accuracy to sub-meter levels.”

Other Challenges. Performance stability of the antenna and its characterization will become the main challenge to exploiting the new GNSS ASICs (application-specific integrated circuits) and correction services at their highest level of performance, Pun said. “A positioning engine can exploit this information to accelerate the convergence to the high-accuracy solution, and then improve its availability.”

Eos Positioning Systems

A surveyor uses the Arrow Gold receiver to map assets in Terrebonne, Quebec, Canada. (Photo: Eos Positioning)

“The past three years have seen considerable innovations and trends in the GNSS industry,” said Jean-Yves Lauture, CTO of Eos Positioning. “Receivers are becoming increasingly affordable and the adoption of higher-accuracy (submeter, centimeter) positioning by other industries, outside of conventional surveying, is growing. Considering the now four usable GNSS constellations and the aggressive launches of Galileo and BeiDou satellites, the number of available satellites and the list of frequencies they use has considerably increased.

“Although accuracy itself is not really improving, performance is — particularly in tougher conditions. It’s not uncommon for customers to use 30 to 35 satellites out of more than 40 in view using an Arrow Series GNSS receiver. The numbers are even higher in the Pacific regions, thanks to geostationary BeiDou satellites. This is, by far, more than double the number of satellites available with just GPS and GLONASS.”

Consumer Devices. “It will be challenging for smartphones and consumer devices to achieve survey-grade accuracy in the next few years. They face certain limitations. For instance, there is a cost and physical size associated with using a high-end GNSS antenna with a minimum of ground plane to achieve these levels of accuracy.

The Arrow Gold RTK GNSS receiver. (Photo: Eos Positioning)

“Also, it is unlikely that the manufacturers of consumer devices will invest in developing the advanced algorithms needed for a high level of constant accuracy and performance. In order to fit into a smartphone, consumer-grade GNSS chipset manufacturers must drop the use of many available signals and frequencies to keep both size and power consumption to a minimum.”

Allystar Technology

Photo: Allystar

Jamming and Spoofing. The GNSS chip in Allystar’s TAU1301 module supports eight adaptive notch filters to reduce the effects of GNSS jamming, explained Shi-Xian Yang, senior principal engineer in the company’s Baseband Algorithm Department. “It significantly improves the performance of GNSS tracking measurements, even in the presence of strong and fast-varying jamming signals.”

Sensor Fusion. The TAU1310 integrates a six-axis micro-electromechanical system (MEMS) gyro, which makes its affordable for the mass market, Yang said.

The Lenovo Z6. (Photo: Lenovo)

Consumer Devices. In its Z6 smartphone, Lenovo has taken advantage of the great improvement in multipath mitigation provided by the L5 signal’s higher chip rate and the output of high quality raw data via the TAU1302’s HD8040 GNSS chipset to improve the accuracy experience in the consumer market, Yang explained. Additionally, he pointed out, cell phones and other consumer devices now enable developers to access the raw sensor data from such sensors as accelerometers and barometers to input into their fusion algorithms.

Other Challenges. In the future, the TAU1310 could also support the L6 signal for PPP-RTK application.

NTLab

NTLab anti-jamming GNSS receiver. (Photo: NTLab)

Jamming and Spoofing. The problem of jamming and spoofing worries customers, according to Konstantin Yuriev, lead GNSS engineer at NTLab. The combination of anti-jam and anti-spoofing is in greater demand because the anti-jam feature alone is becoming insufficient. Yuriev cited the European Union’s new requirements for the European Railway Traffic Management System (ERTMS), which makes anti-spoofing mandatory.

The key issue today is “the solution to the problem of reducing the size and cost of anti-jam receivers, so that they become available to consumers on the civilian market. The key technology for this will be increasing the degree of integration of the component base, first creating a chipset for solving anti-jamming and anti-spoofing tasks, and then moving on to a single-chip solution. We have created a chipset and are ready to start work on the further integration into a single chip.”

Sensor Fusion. The traditional task of integrating data from a GPS antenna and a MEMS sensor has been solved, Yuriev said, with many such solutions on the market. One task is to track the antenna’s tilt. “The antenna, GNSS receiver, and MEMS sensors should be located very closely to each other — if possible, on a single small board,” Yuriev said. “Here, again, the solution is to increase the degree of integration, up to placing the baseband processor on the same chip with the digital CMOS circuitry of the MEMS sensor.” Another application of MEMS is serving as the core of an inertial navigation system (INS), providing an auxiliary subsystem for detecting the presence of spoofing. “This is more of an algorithmic task,” Yuriev said, “because traditional coupling using recursive filters is not enough. It is necessary to ensure the independence of the INS subsystem from the GNSS solution, or their intelligent mutual cross-control.”

Surveying. A major part of the cost of a survey-grade device, Yuriev pointed out, is for additional services, know-how, and other added values. There is market demand for a business model in which device price could go down while maintaining the main values for the customer. “This could be achieved if end-users tightly cooperate with hardware manufacturers, skipping third-party integrators. Alternatively, multiple third parties could compete, keeping the cost of the software low. One of the technical solutions for this is to provide software application programming interfaces (APIs) that will allow multiple third parties to offer application-level software for the same hardware. We call it the ‘open platform’ approach. One of our products implements this strategy.”

Other Challenges. Despite some skeptics, Yuriev argued, new GNSS systems have been successful. “A good example is IRNSS (NavIC), with India’s population of 1.3 billion forming a potential market. Moreover, according to our studies, good coverage is provided not only in India’s territory. We are working on creating an economically affordable solution with support for the NavIC S-band. A new chip-scale packaged RFIC (radio-frequency integrated circuit) should minimize the size, consumption, and price of NavIC-oriented modules, while maintaining all the advantages of the S-band signal in areas close to the equator. This is our solution to the problem.”

TeleOrbit

GOOSE platform. (Photo: Fraunhofer IIS)

GNSS Receiver Development Platform. The company’s GOOSE platform is a field-programmable gate array (FPGA)-based GNSS receiver, developed by Fraunhofer IIS, making it flexible in processing new or proprietary signals, according to Katrin Dietmayer, software development engineer at Fraunhofer IIS. “It comprises 60 hardware channels in real time and provides an open software interface for customer applications,” she explained.

Jamming and Spoofing. “It grants deep access to the hardware interface, down to, for example, the correlation values. Additionally, anti-jamming functions (such as notch-filter or pulse-blanker) can be added and anti-spoofing algorithms are already implemented. Thanks to the open architecture, our customers can also implement these or other algorithms.”

Sensor Fusion. Vector tracking in real time is already implemented on code base. Deep coupling with INS/IMU multi-sensor fusion — for example, with an odometer, ultra wideband or 5G — are possible and under development, Dietmayer said.

Surveying. TeleOrbit provides GNSS-RTK using RTKLIB. “The implemented Open GNSS Receiver Protocol (OGRP) is fully documented with a parsing tool using CONVBIN from RTKLIB as RINEX converter,” Dietmayer explained.

Consumer Devices. GOOSE is also used as the reference receiver in the ESA project Receiver Technologies for Future Mass Market (RT4FMM) devices. The project validates state-of-the-art dual-frequency mass-market receivers based on Broadcom BCM47755 and u-blox F9 and compares their performance against GOOSE E5AltBOC processing.

Other Challenges. GOOSE already processes the new Galileo OS-NMA (Open Service – Navigation Messages Authentication), while implementing the new Galileo High Accuracy Service (HAS) is on the roadmap. “The combination of these new features will result in a robust and reliable high-accuracy position,” Dietmayer said. “For system testing, the intermediate frequency signals can be recorded, processed and replayed with the platform.”

Tersus GNSS

The Oscar. (Photo: Tersus GNSS)

Jamming and Spoofing. Xiaohua Wen, founder and CEO, said his company has done much research and testing on jamming and spoofing. “We already implemented a high dynamic analog-to-digital converter to overcome jamming. To mitigate spoofing, we think that internet of things (IoT) devices can leverage cloud services. Alternatively, the new Galileo authentication service may serve the same function.”

Sensor Fusion. Tersus GNSS makes an INS product, and its Oscar receiver contains an inertial measurement unit (IMU). “The sensor fusion hub is a very hot topic in the automobile industry,” Wen said. “We are quickly adapting our Oscar and INS product line for the creation of high definition maps and for indoor navigation. We think it’s still the major pain point for a crowded country such as China.”

Surveying. As has been the case in many other industries, Wen said, the widespread adoption of GNSS technology and the increase in the number of players in the field has led to a drop in prices. “Tersus’ David and Oscar models are low cost but still perform well compared with Tier 1 players for professional survey machines using our own OEM GNSS board,” he said.

Consumer Devices. The fact that a few vendors are providing dual-frequency chipsets in smartphones opens the door for consumer-grade sub-decimeter applications, Wen said. “But we think the antenna could be a big challenge for the small devices.”

Other Challenges. “Mobile carriers are building thousands of base stations,” Wen said. “For example, Softbank in Japan completed 3,300 stations this year. China Mobile just issued a bid for a phase one project for 4,400 stations. We think mobile phone innovations for the new high-accuracy application may have some impacts in the coming years. We have been actively looking at some new GIS (geographic information systems) applications based on our in-house Nuwa platform.”

Gilla detta:

Gilla Laddar in …